When is a “Double-Dip Recession” Really a Depression

When is a “Double-Dip Recession” Really a Depression

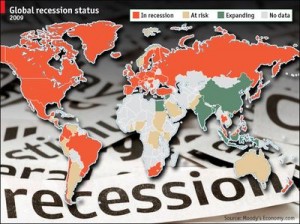

Now that the economy is showing signs of slowing,?talks of a?double-dip recession are growing louder by the day. I must admit I’m?not a big fan of the?double-dip recession thesis since it?presumes that our economy actually recovered.?I believe what we are currently experiencing can more accurately be described as a?depression.

Now?I understand there is?a lot of confusion?over what a depression is. Before the Great Depression, what we would now call a recession was called a depression.?The Great Depression was simply so severe that it?required a qualifier.

So what is a depression? While economists don’t agree on what constitutes a depression, it’s safe to say that depressions are determined by two variables: severity and duration. The data shows that on both counts the current downturn is unlike any recession we’ve seen since WWII.??I think it’s pretty clear we are experiencing at least a “soft” depression.

Real Final Sales

Real final sales, which strips out?inventory from GDP,?are an indicator of organic demand in an economy.

Generally recessions end when real final sales are either flat or rising from the beginning of the downturn. However in the current downturn, real final sales are down 1.6%, which is an unprecedented drop in a supposed recovery. The steep drop in real final sales?reflects the inordinate effect of inventory restocking?on GDP over the past year. Now that the inventory cycle has run its course, GDP is likely to come under pressure; we may very well see negative prints in the second half of 2010.

GDP

If there’s one indicator economists focus on as a harbinger of a recovery, its GDP growth. Given that we have seen 4 straight quarters of GDP growth, many economists believe the recession is over.

However, one must consider the time in which it takes to create real GDP growth. Depressions are depressions for a reason: they are drawn-out affairs characterized by sub-optimal growth. Judged against prior recoveries out of recessions, the current recovery is very sluggish.

Another obvious factor when judging GDP growth is the debt factor. Our leaders inundate us with mindless?drivel? about GDP growth all the time. Unfortunately,??all growth is not created equal, with debt-financed GDP growth being the most harmful for our long-term prospects.

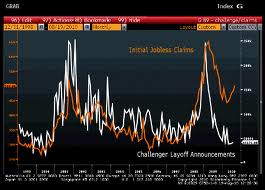

Unemployment

It goes without saying that there can be no recovery without an upturn in employment. The unemployment situation hasn’t materially improved since?the absolute?trough?last year. It is safe to say that this is the severest downturn in employment we’ve seen since the Great Depression.

The current recession is by far?the most severe in terms of the drop in the employment-population ratio.

History gives us most of the tools we need to understand the current situation. The Great Depression wasn’t a continuous downturn, but?a volatile period with many false recoveries. There was a 2-3 year period when the public was convinced a sustainable recovery arrived. Tremendous government stimulus courtesy of FDR created a false recovery that led to a second major downturn.

Since there were two?major downturns in the Great Depression, why doesn’t anyone call the Great Depression a “double-dip” depression? After enough time, it is simply a depression. What we are likely facing is a decade or so of sluggish growth and high unemployment. So forget about talks of a “double-dip” recession- this is a depression plain and simple. This should be increasingly clear into 2011.

by CONTRARIAN

Published: August 17, 2010