The following are some important investment property financing guidelines:

The following are some important investment property financing guidelines:

Having a Good Credit Scores

A good credit score is not important for being a successful real estate investor, but it can help. To acquire long term buy and hold properties, traditional bank financing at some point is needed. Traditional banks require a good credit scores, so it’s important to regularly monitor your credit and make sure all payments are on time.

Be careful not to over spend and use your credit card. If your credit card balances are more than 30% of your credit limit, it can hurt your credit scores.

Be prepared to have Reserve funds.

Having adequate reserves is important when qualifying for financing. Hard moneylenders and traditional banks like to see that you have the money to do the deal and cover the UN expected.

Hard money guidelines vary depending on the lender, but if you’re working with a traditional bank be prepared to have documents from 6 months to one year worth of payments in reserve.

Cash is not always king.

A lot of real estate investors like to pay cash for deals, but this can become a problem if they later wish to take out a bank loan and keep the property long term. It used to be that investors could pay cash for a property, rehabbing it, and cash out with a bank loan immediately, but Fannie Mae guidelines now require 6-month ownership seasoning before you can do a cash out loan.

Instead of paying cash, consider purchasing with hard money. When you need to convert to a permanent bank loan, you can structure the loan as a rate and term refinance and avoid the 6-month seasoning issue.

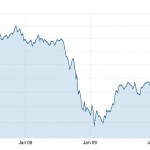

Speculating on Rising Home Values to Make your Money!

A lot of investors lost their money speculating on rising home values during the housing boom when the market turned against them. This is not investing, this is gambling, and this kind of strategy isn’t going to work in today’s market unless you get lucky.

It’s important that you structure your deals so that your profits are built in when you buy. In other words, buy your rehab deals with enough margins that you can make money even if an unexpected expense arises. Buy your rentals based on current, realistic expenses and cash flow, not what they might be at some point in the future. Building your profits into your deals when you buy will make it far easier to obtain the financing you need to get the deal done.

You have multiple exit strategies.

Hard moneylenders want you to have multiple exit strategies. Hard moneylenders lend on a short-term basis, and they like to see that you have a contingency plan for repaying them in case your plan “A” fails. Structuring your deals so you have more than one exit strategy will greatly help you when you’re asking for money to finance the deal.

Buy right.

Don’t speculate on rising home values, speculating is not investing! “Lots of people made money this way during the housing boom T

Investing is accepting some risk in order to get returns on your investment.

Take control of your deals and structure them so you have built-in equity or positive cash flow when you buy will greatly increase your odds of success.

By Adma Dababneh

Other Related Articles: