Whenever there has been a world crisis, it has been typical for foreigners to seek the safety of the US dollar. A common means to accomplish that has been to buy US Treasury debt. The typical example over the past couple of years is that the demand for US Treasury debt has increased at the various peaks of crises among the European Union nations such as Greece, Ireland, Spain, Portugal, and the like.

As a result of these surges in demand, the US Dollar Index, which reflects the value of the dollar against other currencies, tends to increase.

The major earthquake, tsunami, and nuclear power plant problems that hit Japan on Friday, March 11 is a crisis that should have, once again, had the effect of increasing demand for US Treasury debt and pushing up the value of the US dollar.

That is not what happened.

Late Thursday, March 17, the G-7 Group of Nations announced that it would coordinate a currency manipulation at the open of each member’s markets the next day to sell Japanese yen to push down its value. The planned manipulation would also have the affect pushing up the value of the other currencies.

Japan’s market was the first to trade on March 18. The value of the US dollar quickly soared 3% to reach an Index of 81.75. Then the bottom fell out.

By the close of trading in the US market on March 18, the US Dollar Index had fallen all the way to 75.69, a 7.5% intraday decline! This was the lowest close for the Index since late 2009.

On Monday, March 21, the US Dollar Index fell even further, finishing in the US markets at 75.41.

The decline of the US dollar has to be understood in a wider context. Many of the nations that are part of the basket of currencies against which the US Dollar Index is measured have themselves been actively trying to lower the value of their own currencies. For the US dollar to still fall in value against these other depreciating currencies is a sign of extraordinary weakness. Had some other nations not been trying to lower the value of their currencies, it is likely that the US dollar would already have fallen to an all-time low value.

As the value of the US dollar declines, US Treasury debt interest rates will have to rise in order for foreign and domestic investors to be willing to hold the debt. Strangely, that is not what has happened over the past ten days.

In fact, the 10-year US Treasury debt interest rate has fallen over the past week or so. It closed on March 21 at 3.32%, well below the 3.5% level which would confirm the fall in the value of the US dollar.

I think there is an explanation of this anomaly. If the Federal Reserve has stepped up its purchases of US Treasury debt, either directly or through intermediaries, that would hold down the interest rate but would not have the same effect of pushing up the value of the US dollar.

As of the end of 2010, 45% of all US Treasury debt was held by China, Japan, and various Middle Eastern governments. China is suffering its own domestic financial crisis, where it has been reducing the amount of US Treasury debt it holds. To generate the funds to recover from their earthquake catastrophe, Japan is going to have to reduce its holdings of US Treasury debt and cut back on new purchases. Many Middle Eastern governments are now scrambling to raise funds in order to use the largesse for projects to mollify their citizenry. As a result, Middle East demand for US Treasury debt is also bound to decline.

Even in the US, Treasury debt demand is falling. The Pacific Investment Management Co, (PIMCO), the world’s largest bond fund, has sold off all Treasury debt held by at least two of its largest funds.

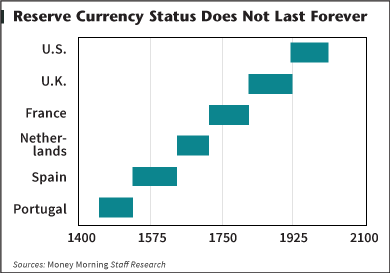

This turmoil will accelerate the loss of safe haven status for the US dollar. In 2001, the US dollar was the unit of account for 90% of all foreign exchange transactions. Dollars and US Treasury debt made up 71% of global central bank reserves. By 2010, only 85% of all foreign exchange transactions were handled in US dollars while dollars and US Treasury debt had fallen to only 61% of central bank reserves. Although the dollar is still dominant, it is on the wane as the world’s reserve currency.

As the dollar continues to lose value, assets such as gold and silver will appreciate. There is still time to protect the remainder of your personal wealth, but it would be best to act sooner rather than later.

Article by By Patrick A. Heller

Other Stories

How to Invest

Gold will continue to shine

British Pound Continues Gradual Ascent

Stocks Rally After Three-Day Slide; Oil, Commodities Advance, Euro Weakens

Japan crisis puts world financial markets on edge

Buy, Sell or Hold

Currency Investing Where to Turn

Oil could reach $300 a Barrel

Gold prices will hit $2,500 in the near future

Global Investing Strategies

Profit From the One Company That Will Win the “Mobile Internet” Gold Rush

Different Investment Methods

Trade Spot Gold Online

Trade Oile Online

Trade Commodities Online

With Egypt in Turmoil, Oil and Food Prices Climb

Why you should Buy Rice Future

Shares rally as Mubarak resigns

Why you should Buy Rice Future