Charts

Charts

A chart is a visualised representation of the price movements, a reflection of the psychology of the market and a visualization of the interaction between buyers and sellers in the market. Because it is a reflection of all the activity that has taken place for a particular traded instrument, a chart also shows how the market values a particular asset based on all the information available.

There are three major kinds of charts: bar charts, candlestick charts, and line charts. Most traders use candlestick charts, because they are the most commonly used charts amongst active traders.

Candlestick chart:

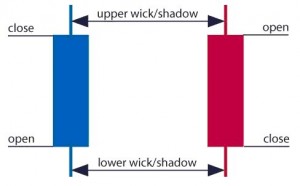

A candlestick contains the market’s OPEN, CLOSING, LOW and HIGH price of a specific time frame. The main difference is the candlestick’s body part, which represents the range between the opening price and the closing price of that particular time frame.

When the body part is filled with RED (or BLACK), it means the closing is lower than the opening. When the body part is filled with BLUE (or white), it means the closing is higher than the opening.

While the bar charts put more emphasis on the progression of closing price from the last bar to the next, while the candlestick charts put more emphasis on the relationship between the opening and the closing price within the same time frame.

Above and below the candlestick’s body are the ‘wicks’, while the wick on the top is the highest price and the wick at the bottom is the lowest price of that period. Candlestick charts are more popular than the bar charts and the line charts.

Daily chart, each candle represents a 24 hours period.

It contains information of the daily open and daily closing price, the highest and lowest price during that day.

Hourly chart, each candle represents an hour and so on.

Since the forex market is a 24 hours market, there is no real daily open or closing price.

Different chart providers may have different choices for the open and closing time.

Traders may find the charts from different providers are slightly different to each other.

Candlestick patterns?

There are recurring patterns on the candlestick charts.

Such patterns they tend to occur when a trend is about to end or reverse its direction.

The patterns are very good visual representation of the price movements and give traders a good grasp of what is going on in the market.

Patterns are Important

Candlesticks are the best gauge of what is going on in the market at the present time.

If a candlestick is very short, it implies that the range for the trading day was very tight.

If this candle appears after a strong up-trend, it may suggest that sellers have now begun to enter the market more aggressively, and thus the price may be on its way back down.

Candlesticks patterns used to identify potential reversals of trends in the market – especially when used in conjunction with other indicators. By observing the candlestick patterns, traders can speculate potential reversals of trends and entering the market with strong reference to the patterns.

Bar Charts

Bar charts provide traders with four key pieces of information: the opening price ;

the closing price;

the high price;

the low price.

Bar charts can be applied to all time frames, and hence a single bar can summarize price activity over the past minute or over the past month. Different traders use time frames in various manners, although a good rule of thumb is that the longer the time frame, the more significant it is as it will account for more data — and hence will be a better reflection of the market’s psychology.